Facturación Electrónica

Facturación Electrónica integrado completamente con Quickbooks.

Cuenta con todos los lineamientos de la DGT-R-48-2016.

Creación de notas de crédito y débito.

Respalda todos sus documentos.

Recibe facturas externas.

Envió de facturas por correo electrónico.

Creación de tiquetes electrónicos.

Integrado Completamente con quickbooks

Si cuenta con el sistema Quickbook puede integrar todas las facturas que ingrese directamente con el módulo de contabilidad.

Se integra con múltiples plataformas de ERP

El sistema le permite integrar su plataforma de facturación ERP de preferencia como: QuickBooks, Codisa, Exactus, SAP o con cualquier otro sistema de facturación del mercado.

todos los lineamientos de la DGT-R-48-2016

Factura electrónica esta desarrollado bajo los estándares de Hacienda.

Creación de notas de Crédito y Débito

Si ingresa facturas con algún error el sistema le permite crear notas de crédito y débito para poder corregirlas.

Respalda todos sus documentos

El sistema mantiene un respaldo de sus facturas electrónicas durante un plazo de 5 años en caso de que hacienda los solicite.

Recibe Facturas Externas

El sistema le permite aceptar y rechazar facturas de los gastos que realice su empresa, los cuales puede declarar.

Envío de facturas por correo electrónico

Cada vez que se emite una factura llega a su cliente por medio de correo en PDF junto al XML.

Tiquetes Electrónicos

El sistema le permite crear tiquetes para facturar a clientes sin datos, excelente para negocios como Minisúper o Bazares.

Si desea iniciar su negocio o requiere mejoras en el equipo y sistemas contamos con el asesoramiento y todo lo necesario para desarrollar su proyecto.

- Microsoft Office 365.

- Microsoft Azure.

- Microsoft 365.

- Telefonía IP.

- Leasing tecnológico.

- Desarrollo de Software.

- Licenciamiento de software.

- Redes y cableado estructurado.

- Implementación de servidores e Infraestructura.

- Soporte técnico.

Si necesita financiar su proyecto contamos un amplio inventario de artículos para punto de venta.

- Laptops y Servidores.

- Lectores de códigos de barras.

- Impresoras POS.

- Monitores de comandas.

- Gabinetes de dinero.

Plan 1

Tipo de contribuyente

Personas físicas y PYMES , profesionales, trabajadores independientes

Documentos Electrónicos

40 Documentos anuales

Precio Mensual

N/A

Precio Anual

$ 30,00

Plan 2

Tipo de contribuyente

Solo personas físicas, servicios profesionales, trabajadores independientes

Documentos Electrónicos

Documentos Ilimitados

Precio Mensual

$ 9,00

Precio Anual

$ 92,5

Plan 3

Tipo de contribuyente

Personas jurídicas, especial para PYMES.

Documentos Electrónicos

200 Documentos anuales

Precio Mensual

$ 10,55

Precio Anual

$ 110,55

Plan 3

Tipo de contribuyente

Personas jurídicas, especial para PYMES.

Documentos Electrónicos

550 Documentos anuales

Precio Mensual

$ 30,70

Precio Anual

$ 322,50

AM Version Estandar

AM Version Estandar

Aceptación automatica vía correo electrónico

Cómo empezar con la facturación electrónica (Costa Rica)

Sabemos que el tema de Facturación Electrónica puede parecer muy complicado y costoso, pero no tiene que serlo! En ITCO hemos desarrollado una integración que cumple con todas las regulaciones de la Resolución DGT-R-48-2016 y sus reformas para que usted no tenga que preocuparse!

No olvide revisar la fecha en que este formato será obligatorio para su industria.

Las siguientes instrucciones son los 3 pasos que usted deberá realizar, el resto lo hará ITCO por usted!

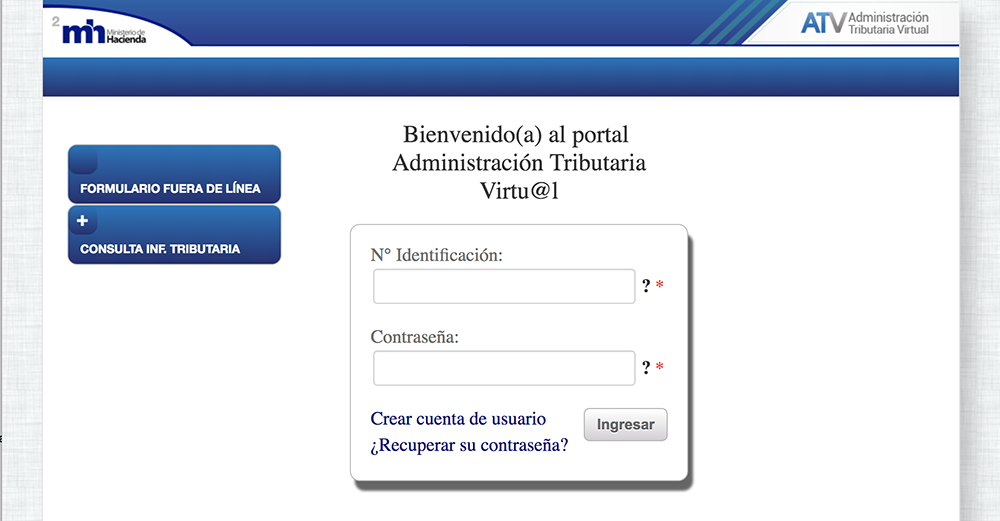

Paso 1: Generar llave Criptográfica y Certificado de Producción

Visite el sitio Administración Tributara Virtual (ATV) https://atv.hacienda.go.cr/ATV/login.aspx, e ingrese su número de identificación y contraseña.

Seleccione en “Perfil de Usuario” entre los tipos: Representante Legal u Obligado Tributario.

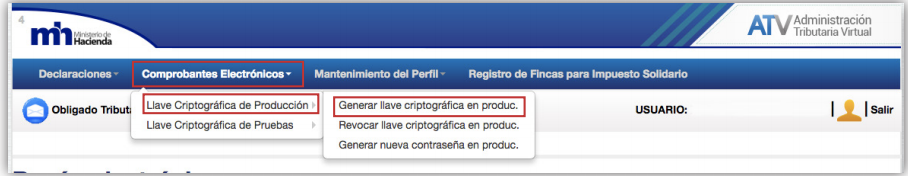

Dé clic en la opción “Comprobantes Electrónicos” que visualiza en la barra principal y seguidamente ingrese a “Llave Criptográfica de Producción” y luego a “Generar llave criptográfica en producción”.

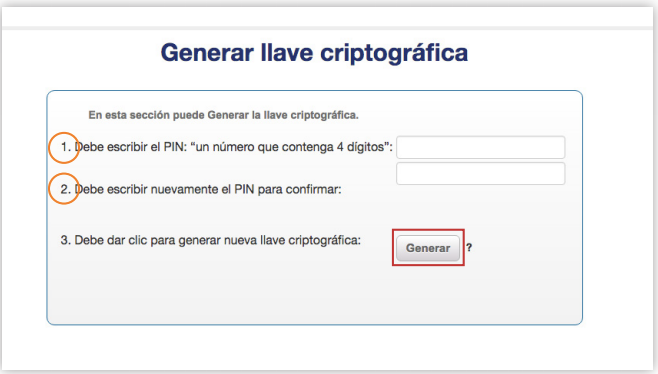

Seguidamente, se visualizará un recuadro, en el cual se deberán completar los puntos 1 y 2. El PIN que se solicita generar, se necesitará más adelante en el Paso 3. Por último, dé clic sobre el botón “Generar” en el punto 3 y este cambiará a “Procesando”, seguidamente se habilitará el punto 4, y para continuar dé clic en el botón “Descargar” y luego “Acepte”. Tal como se muestra a continuación:

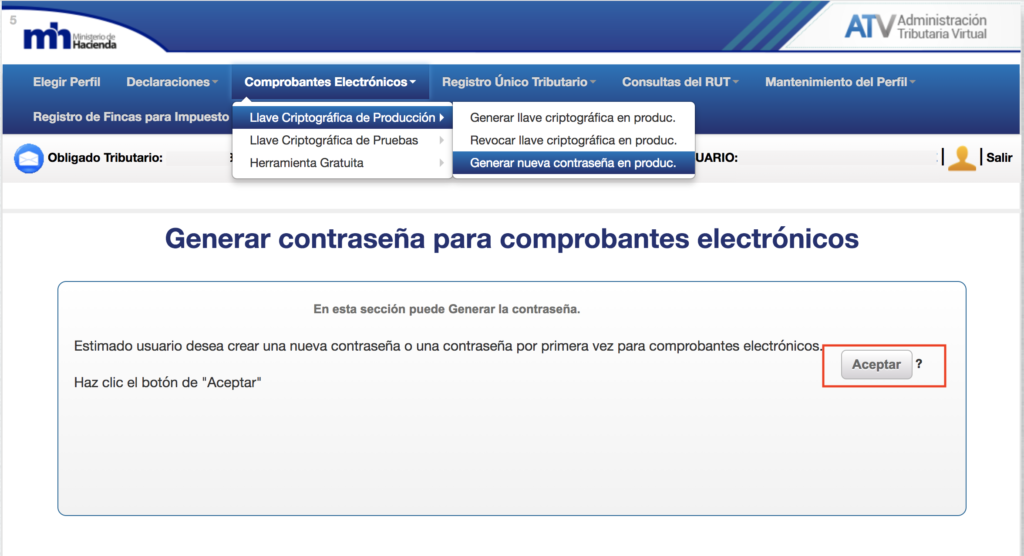

Paso 2: Generar Contraseña de Producción

Para generar su contraseña, dé clic en la opción “Comprobantes Electrónicos” que se visualiza en la barra principal y seguidamente ingrese a “Llave Criptográfica de Producción” y luego a “Generar nueva contraseña en producción” y luego de clic en “Aceptar” en el cuadro de dialogo siguiente:

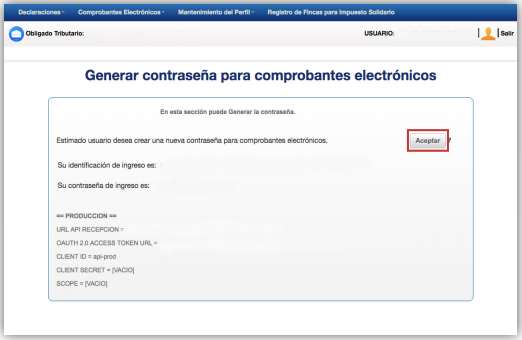

Luego de dar clic en “Aceptar”, en el cuadro de dialogo, el sistema le indicará que ya se generó con éxito la contraseña para comprobantes electrónicos. *Una vez que el sistema muestra las credenciales en pantalla, no vuelva a hacer click sobre “Aceptar” ya que esto revocará los credenciales y generará unos nuevos.

Modifica el Registro Único Tributario en la Administración Tributaria Virtual (ATV) de Costa Rica.

Para poder iniciar con la emisión de comprobantes electrónicos, se debe realizar el registro de factura electrónica en ATV siguiendo estas instrucciones: Modificar el Registro Único Tributario en la Administración Tributaria Virtual (ATV).

¡Listo!

Ha completado su configuración de Facturación Electrónica. Si tiene alguna pregunta, o requiere soporte, siempre estamos disponibles en: [email protected]